does new mexico tax pensions and social security

Beginning with tax year 2022 most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal Income Tax returns. Read an opinion editorial by Fred Nathan supporting the compromise proposal to repeal the tax on Social Security income for all middle and lower income New Mexicans February 15 2021.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

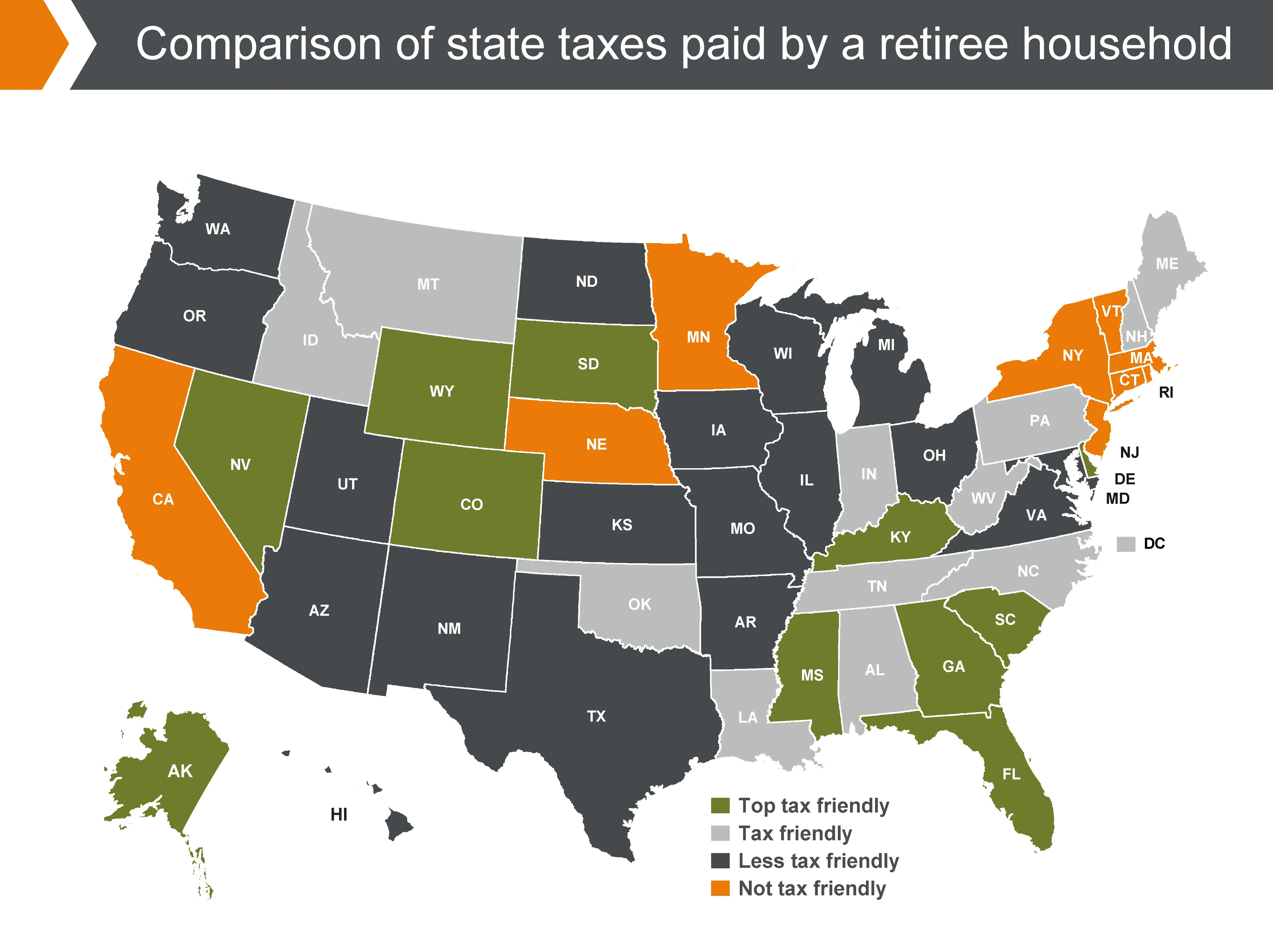

Alaska Nevada Washington and Wyoming dont have state income taxes at all and Arizona California Hawaii Idaho and Oregon have special provisions exempting Social Security benefits from state taxation.

. Most of the people paying this tax in New Mexico are middle and lower income. Read a guest editorial by Kristina Fisher about the need to. Furthermore there is no standard deduction.

IRS for tax year 2017 and using a guesstimate of the average New Mexico tax rate faced by New Mexico recipients of taxable Social Security benefits. Railroad Retirement benefits are fully exempt but New Mexico taxes Social Security benefits pensions and retirement accounts. The bill eliminates taxation on social security saving New Mexico seniors over 84 million next year.

The bill includes a cap for exemption eligibility of 100000 for single filers and 150000 for married couples filing jointly. It allows individuals aged 65 and over with a GDI of 51000 or less for married couples and 28500 or less for singles to deduct up to 8000 in income that can be applied to benefits. In New Mexico low income retirees are not taxed on their social security income.

Nine of the 13 states in the West dont have income taxes on Social Security. Yes Up to 8000 exclusion. Up to 20000 exclusion for pension annuity or Def.

The New Mexico Legislature on Thursday passed a bill eliminating taxes on Social Security benefits for individuals with less than 100000 in annual income or couples with less than 150000 in. E-FIle Directly to New Mexico for only 1499. Starting in 2022 all military retirees may exclude 50 percent of their military.

For more than half a century after Social Security was enacted in 1935 Social Security benefits were not taxed in New Mexico. But the tax will be eliminated for those who earn less thanks to a new tax package recently signed into law by Gov. New Mexicos tax on Social Security benefits is a double tax on individuals.

Taxable as income but low-income taxpayers 65 and older may exempt up to 8000 of income from New Mexico taxes. Read an article from the Santa Fe New Mexican on the successful repeal of the tax on Social Security income March 9 2021. Otherwise New Mexico treats Social Security benefits for tax purposes in the same way as other income.

When New Mexicans are working the state taxes the money that is taken out of their paychecks for Social Security. New Mexico is one of only 12 states that tax Social Security income and it is a form of double taxation since New Mexicans pay income taxes on the money they put into Social Security and then they are taxed again on the benefits they receive. While I often discuss tax-free states with regard to pensions and Social Security I also emphasize that the total tax burden is more important.

Currently New Mexico includes all Social Security benefits in the taxable income base though the state provides a deduction that reduces the taxability of all retirement income. The exemption is available to single taxpayers with less than 100000 in income to married. No New Hampshire tax on them.

The exemption gradually phases out as income rises and it. Tax relief from the new Social Security exemption is expected to total 841 million in the first year. 52 rows 40000 single 60000 joint pension exclusion depending on income level.

Unlike in the US Mexican tax reporting laws require that spouses report their income separately. That leaves Colorado Montana New Mexico and Utah. The tax costs the average New Mexico senior nearly 700 a year.

Mexico follows a progressive personal tax rate system with top earners paying 35 and the poorest paying less than 2. For 2022 theres a. Social Security Benefits.

New Mexico is one of only 12 states that tax Social Security income and it is a form of double taxation since New Mexicans pay income taxes on the money they put into. And 12 states Colorado Connecticut Kansas Minnesota Missouri Montana Nebraska New Mexico Rhode Island Utah Vermont and West Virginia can tax all or part of your Social Security benefits. Same goes for Social Security benefits.

Its important to note that New Mexico does tax retirement income including Social Security. Social Security benefits will still be taxed for beneficiaries in New Mexico who earn more than 100000 each year. Then when they retire they are taxed again on the benefits they receive.

Today New Mexico is one of only 13 states that tax Social Security benefits. AARP New Mexico State Director. New Mexico tax rates range from 17 to 59.

New Mexico is one of only 12 states that taxes residents Social Security benefits. Otherwise New Mexico treats Social Security benefits for tax purposes in the same way as other income. Assuming an average tax.

Tax info505-827-0700 or taxnewmexicogov. As noted taxable Social Security benefits in New Mexico for tax year 2017 were about 19 billion. If HB 49 gets passed then it would extend to all retirees with social security income.

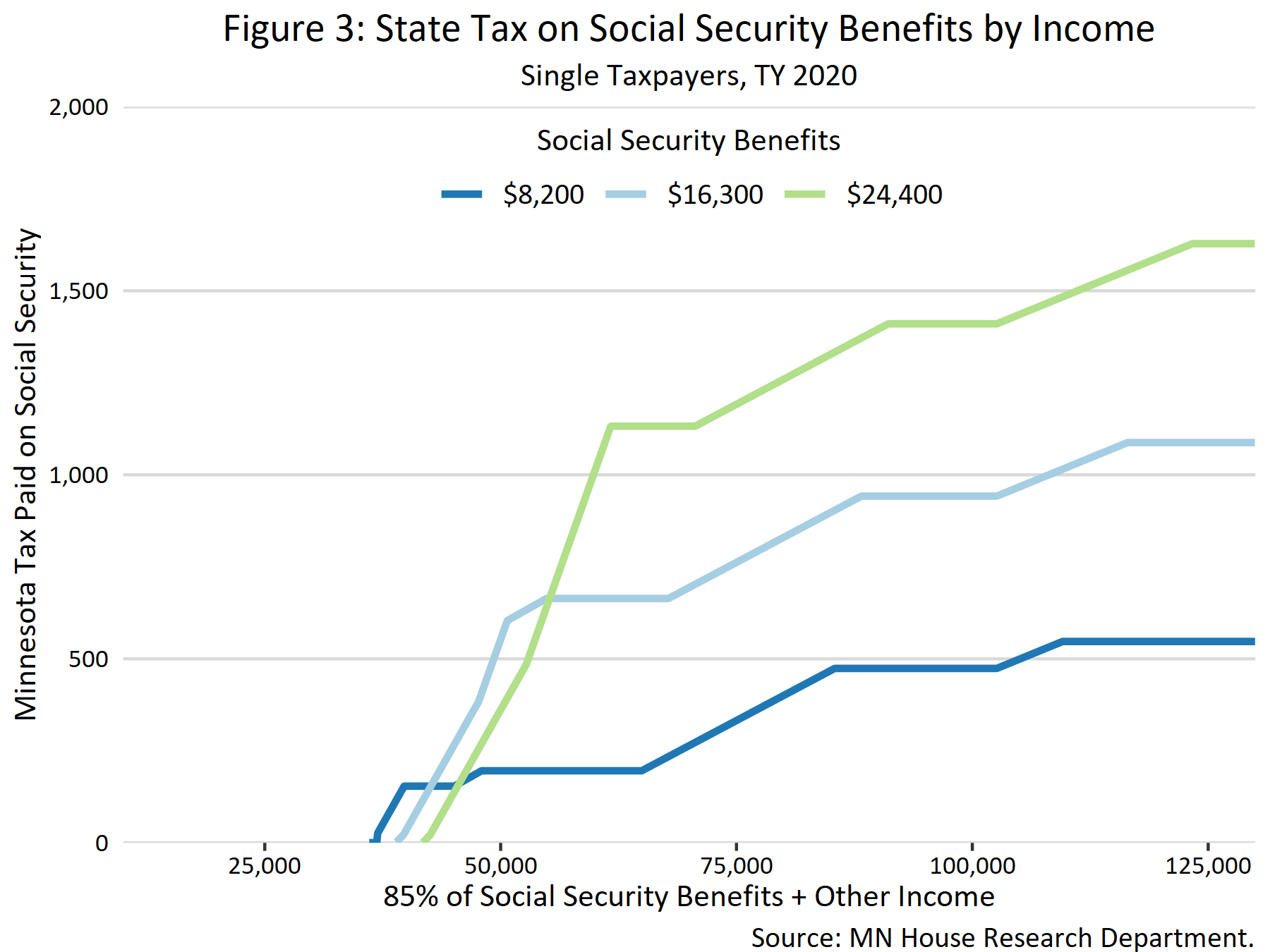

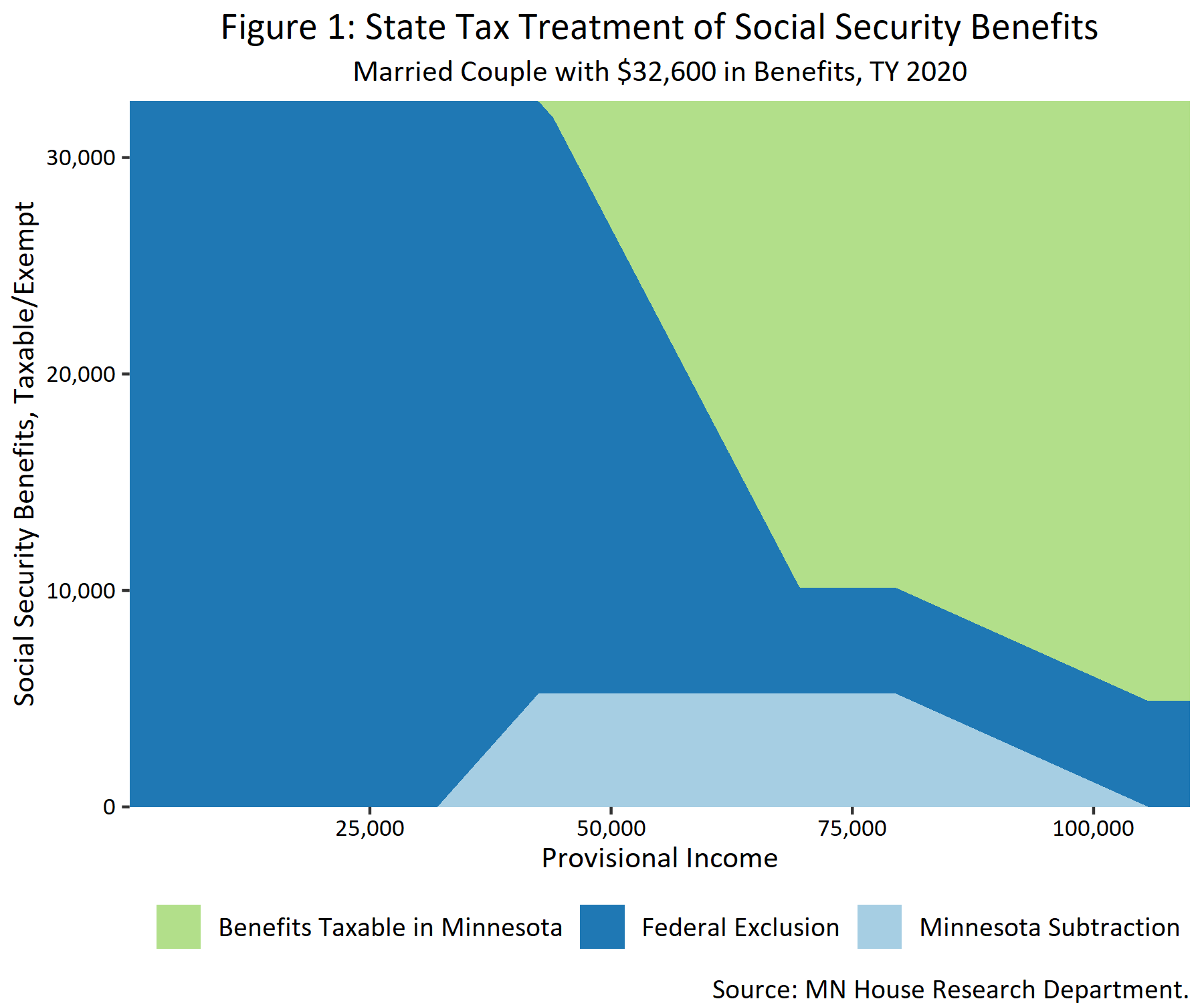

Taxation Of Social Security Benefits Mn House Research

New Mexico May Limit Or Scrap Tax On Social Security Income New Mexico News Us News

Social Security Income Tax Exemption Taxation And Revenue New Mexico

How Taxes Can Affect Your Social Security Benefits Vanguard

New Mexico Retirement Tax Friendliness Smartasset

Social Security Income Tax Exemption Taxation And Revenue New Mexico

Social Security New Mexico Moves Closer To Eliminating Taxes On Most Social Security Benefits Gobankingrates

Tax Withholding For Pensions And Social Security Sensible Money

States With The Highest And Lowest Taxes For Retirees Money

Tax Withholding For Pensions And Social Security Sensible Money

Taxation Of Social Security Benefits Mn House Research

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

New Mexico Eliminates Social Security Taxes For Many Seniors Thinkadvisor

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer

Social Security Double Taxation Does Exist In These 13 States The Motley Fool

Senate Panel Advances Tax Bill With Social Security Income Exemption Albuquerque Journal

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

New Mexico Passes Legislation Including Social Security Tax Cuts Child Tax Credit And Tax Rebates Up To 500 Gobankingrates